Revenue growth is an important part of business. It’s top of mind for so many companies because of its role in supporting expanding operations, keeping ahead of costs and satisfying stakeholder goals, among other reasons. For that reason, it is one of several criteria that factor into industry companies’ PPAI 100 rankings.

Wrestling With 2020

In order to score companies fairly on their revenue growth, it must be measured over a common time span. PPAI 100 measures growth over a three-year period, this year spanning from 2021 through 2023

The wide range of products and customers served by the promo industry, combined with the historically unprecedented nature of 2020, has created several factors complicating the three-year growth rates in 2024’s PPAI 100. And notably, compared to PPAI 100’s figures in 2023, 2020 and its outlier business performances, are no longer part of the three-year growth rate calculation.

The diversity of the promo industry combined with the historically unprecedented nature of 2020 has led to varying factors to consider alongside companies’ growth numbers this year.

- Many companies had to accept lower revenue numbers in 2020, so as social distancing and other factors diminished, the following few years they were able to grow past that period in terms of revenue.

- Some companies, on the other hand, were able to navigate through that period without a significant revenue drop, so their growth trajectories were less primed to shoot up in the following years.

“For the majority of companies across many industries, 2020 was a historically difficult year, so when circumstances began to normalize, up was the only direction for many companies to go,” says Alok Bhat, PPAI’s market economics and research manager. “Those businesses less affected by lockdown conditions or those who successfully pivoted to thrive in those conditions may have had different expectations for their growth in the following years.”

The three-year growth trend of each company in the 2024 PPAI 100 tells a different story. In order to showcase that, let’s look at two suppliers whose growth numbers look dissimilar, but both nimbly reacted to the circumstances of 2020 and what came after.

Gemline’s Steady Progress

Many businesses – both within and outside the promo community – were required to break out, or at least consider, their worst-case scenario strategies at some point in 2020. That was not the case for Gemline, PPAI 100’s No. 11 supplier, which considered its capabilities and offerings against market conditions imposed by COVID-19 and quickly pivoted to personal protection equipment (PPE).

“Gemline’s situation in 2020 was different than most companies in our industry,” says Frank Carpenito, CEO and president of Gemline. “More specifically, we had a record year, with annual growth in excess of 20%, thanks in large part to our pivot into PPE.”

- PPE accounted for over a third of Gemline’s business in 2020.

- It also accounted for 100% of the supplier’s growth that year.

A look at Gemline’s three-year growth metric ending in 2023 shows a positive growth of 22%, a respectable number that suggests a healthy company, but it may not be quite as eye-popping as the three-year growth numbers of several other PPAI 100 suppliers. That is likely in large part because of where those metrics started for Gemline three years ago: coming off a record year.

Carpenito says the company is measuring its 2024 growth against both 2023 and 2022. The revenue of 2020 allowed Gemline to invest in technology and product innovation for the future at a time when many companies were needing to cut back on spending. The result of these dynamics is an excellent growth pattern starting before the pandemic.

“We feel very good about our recent track record of growth,” Carpenito says. “From 2019 to 2024, we grew 42%, versus an industry that was virtually flat.”

Ball Pro’s Big Rise

There’s a decent chance you know someone who golfs quite a bit more than they did five years ago. The first few years of the pandemic reunited many people with their enjoyment of outdoor activities. Ball Pro – the No. 39 supplier in the 2024 PPAI 100 – which specializes in golf products, as well as other sporting goods, was in position to capitalize on that trend.

- Largely as a result, the Midwest supplier boasts a three-year growth rate of 200%.

Nikki Meester, Ball Pro’s VP of finance, says that coming out of social distancing protocols, golf has increased among women and youth, two demographics where the sport had previously lagged.

For a supplier, though, demand only means something if you have the systems in place to take advantage. That is where growth opportunities lie.

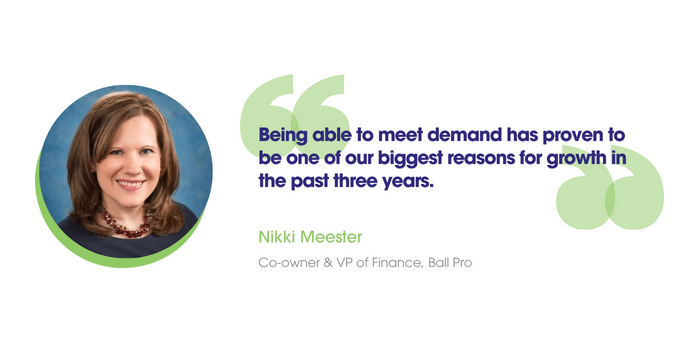

“Being able to meet demand has proven to be one of our biggest reasons for growth in the past three years,” says Meester. “Where our competitors may run out of stock of golf balls, our supply chain team monitors customers’ needs and works closely with our vendors to ensure we have sufficient inventory levels of not only golf balls but also our wide selection of accessories and kit solutions.”

PPAI 100 measures growth based on revenue, which often stems from complete and holistic growth in what a company brings to the market. Alongside the increased demand for golf balls, Ball Pro has grown its catalog of products.

“Our marketing department spearheads this endeavor, but all employees are encouraged to submit new product ideas for consideration,” says Meester. “We spend time attending tradeshows in search of ideas that fit our current product mix.”

A family-owned business with strong employee retention, Ball Pro has applied its institutional preparation and adaptability with beneficial trends in the market to grow into a company with a bright future lying ahead.