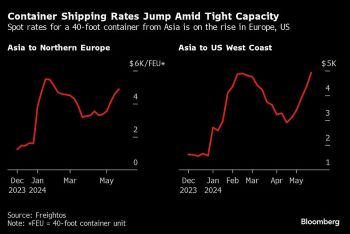

The price to ship goods out of Asia is on the rise in June, reminding importers across many industries of the skyrocketed shipping rates during 2021’s nightmare supply chain circumstances.

- The rate to send a 40-foot container from China to the U.S. East Coast is at approximately $6,000 and rising. That is up nearly 200% from May 1 when the rate was $2,772.

- The same shipment from China to Northern Europe is currently $4,600, up more than three times its May 1 rate.

- Separate from these rates carriers are offering premium/priority rates to Northern Europe for as much as $10,000.

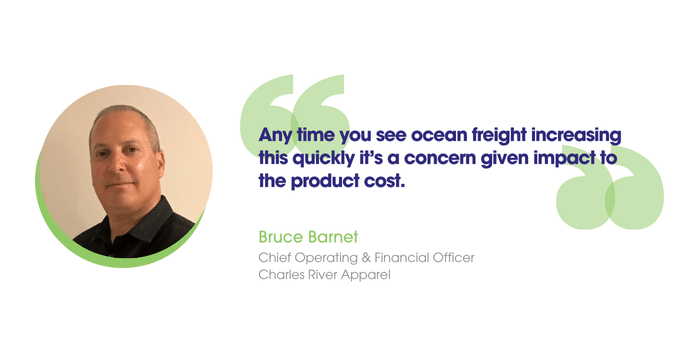

“Anytime you see ocean freight increasing this quickly it’s a concern given impact to the product cost,” says Bruce Barnet, chief operating & financial officer at Charles River Apparel. “It’s important to monitor this situation over the next few months to see if it’s going to be a short- or long-term impact to the industry in 2024 and 2025.”

Chaos in the Red Sea causing disruption to global supply chain logistics is a primary cause of the rising prices. Additionally, tariff exclusions on certain Chinese imports expire in the middle of June. This is also increasing short term demand for shipping as importers race to get goods in under the wire.

Chart provided by Bloomberg

According to Bloomberg, carrier rates from China to the U.S. peaked around $20,000 in September 2021.

Barnet notes that the current confluence of global conditions means that importers should temper their short term expectation for shipping prices.

“While overseas freight demand is still down, it’s certain in the short term you will see price increases through GRI (General Rate Increases) due to container shortages, longer transit times, weather issues and less sailings out of key ports in Asia,” Barnet says.

The Red Sea Crisis Continues

The current political conflict at the Red Sea has had an effect on the global supply chain similar to that of the COVID-19 pandemic.

- Since late 2023, Yemen’s Houthi rebels have been attacking ships in the maritime trade route between the Mediterranean Sea and the Indian Ocean via the Red Sea and the Suez Canal.

- Roughly 12% of world trade goes through the Suez Canal, according to the New York Times.

As a result, many container shipping lines and tanker owners have stopped transiting the Red Sea and are rerouting around the Cape of Good Hope, adding an additional two weeks to the supply chain and reducing global container capacity, according to Reuters.

“We have experienced cost increases related to the Red Seas but have also worked around other issues with our freight forward partner through different sailing routes,” Barnet says.

The ripple effect of not only the longer route but also the ships that have circled back to ports due to the dangers of the Red Sea cannot be overstated. It has led to congestion in ports in Singapore and Shanghai. Without improvement in the viability of transportation through the Suez Canal, shipping conditions and rates are liable to worsen before they get better.

Frank Carpenito, CEO and president of Gemline says that a very preliminary look at June shipping prices has shown that moderate increases are being felt and port pressure has seemed to mostly be concentrated in Northern China, where Gemline has limited traffic.

Chinese Tariff Exclusions Increasing Demand

To make matters more complicated, the United States Trade Representative (USTR) announced the expiration of 233 exclusions to the 301 tariffs on Chinese imports as of June 1. However, the USTR has allowed a grace period through June 14 before tariffs on the affected products go into effect.

- To read the full USTR report, including an exhaustive list of the affected products, click here.

With many businesses having relied upon importing these products out of China, industry observers have speculated that there might be a huge surge of demand to ship goods out one final time before the transition period ends.

The degree to which businesses scramble to import out of China during the grace period will be difficult to measure, but surging shipping rates are a possible indicator. Unlike the Red Sea crisis, this is a phenomenon that will manifest in the short-term, but both the congestion and rate increase, as well increased cost of these products, could have an ongoing effect into 2024.