Editor’s Note: PPB’s May cover story reported key findings from PPAI’s 2018 Sales Volume Study, including sales revenues and market share by distributor size, and year-over-year comparisons for overall sales, profits and sales with non-industry suppliers, among others. The following article, with data from PQ Media, expands the reporting to look at 2018 revenue across the entire advertising and marketing landscape along with trends that spurred the growth.

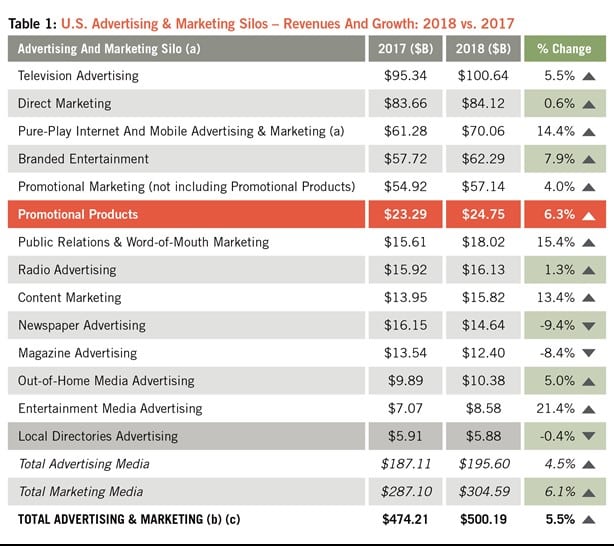

U.S. advertising and marketing revenue reached $500.19 billion overall in 2018, a 5.5 percent increase over 2017. Within the segments that comprise this total, advertising media rose 4.5 percent to $195.6 billion and marketing media grew 6.1 percent to $304.59 billion. Of the 13 advertising and marketing silos, television was the largest in 2018, reaching $100.64 billion. Entertainment media was the fastest growing advertising and marketing silo in 2018, soaring 21.4 percent. Promotional products ranked sixth in both size and growth in 2018, rising 6.3 percent to $24.7 billion. (Note that promotional products advertising is not a silo, but a channel within the promotional marketing silo, and it has been extracted in this article for context with overall brand marketing trends.) See the chart on page 82 for 2018 size and growth of the 13 media silos tracked in PQ Media’s Global Advertising & Marketing Revenue Forecast 2018-22.

There were more contentious elections in 2018 than ever before with toss-ups in eight Senate campaigns, 30 House seats and nine governor races, as well as an additional 17 House and governor races in which the opposing party was favored to unseat the incumbent party (64 total). Since 2000, no election has had more than two dozen toss-ups with incumbents losing. As a result, PQ Media estimates that overall U.S. political media buying reached $6.58 billion in 2018, a 9.6 percent increase over the 2014 campaign. (Note: the 2014 election cycle is being used for the comparison rather than the 2016 campaign because the presidential campaign skews the results). Many of the 13 advertising and marketing silos exhibited higher growth rates due to the infusion of more even-year political dollars.

Historically, brands increase budgets for branded entertainment sponsorships and in-store retailing in every even-year in which global sporting events are held. However, the budget increase in 2018 was less than reported in 2016 for two reasons. First, brands spend more when the Olympics are held in locations where live events can be viewed throughout the day, such as in Brazil in 2016. South Korea, the location for the 2018 Olympics, is 13 hours ahead of Eastern Standard Time. Second, the Winter Olympics are less popular than the Summer Games because most winter sports tend to be followed primarily by residents of northern and midwestern states.

The U.S. economy remained strong in 2018, bolstered by the Trump tax cuts. Brands increased budgets in certain verticals, particularly relating to holidays, because consumers increased their discretionary spending compared with 2017.

Brands are shifting away from a “Total Marketing” strategy adopted by some advertisers soon after the Great Recession. With this strategy, they purchased inventory on media content that had a diverse audience matching census data (e.g., a Super Bowl audience might be 18 percent Hispanics, 15 percent African Americans, six percent Asian Americans). According to a recently released report on multicultural media from PQ Media, in partnership with the Association of National Advertisers, brands are finding that this total marketing strategy lacks engagement with multicultural audiences leading to a decline in market share. Increasingly, brands are using agencies that understand multicultural audiences and which develop culturally relevant messages using media channels that resonate with these audiences.

More franchises filed for bankruptcy and shuttered retail outlets in 2018 than were reported in 2017, which also exceeded the number of closures during the Great Recession. Companies that shuttered all stores included: Bon-Ton, Brookstone, Gump’s and Nine West. Sears avoided that fate when a last-minute deal was struck with a hedge fund. As a result, select brand marketing channels, such as point-of-purchase, coupons and trade promotions, continue to be under stress.

Consumers are becoming more protective of their digital information after the Facebook announcement and Congressional testimony revealed it shared private data without permission with a research company that was used to influence the 2016 elections. Millions of end-users closed their Facebook accounts or increased privacy settings not only on Facebook, but across all social media sites, making it harder for brands to connect with customers on websites that previously provided strong ROI results.

Research released in 2018 reported that ad fraud is worse than initially estimated, with an estimated half versus one-third of all digital dollars ($35B vs. $23B) spent being wasted because of fraud. Simultaneously, brands continue to complain that programmatic media buying causes their advertisements to be placed near objectionable content, leading brands to drop advertising on sites like YouTube.

Brands increased spending on smart tech marketing by nearly 400 percent in 2018, according to the PQ Media U.S. Smart Technology Marketing Forecast 2019, as more advertisers are relying on artificial intelligence (AI), augmented reality (AR), internet of things (IoT), voice assistance (VA) and virtual reality (VR) marketing to develop and distribute brand messages. PQ Media identified more than 150 brands that have used smart technology marketing to actively engage consumers, such as a Fitbit campaign using AI that ran on TNT’s Inside the NBA, BMW’s AR simulators in showrooms, the New York Times’s VR ads for movie trailers, O Magazine’s use of VA for Oprah Winfrey’s “Favorite Things” series in which smart speaker users were sent to websites to purchase products and Tide using IoT to alert Amazon when consumers needed to reorder Tide soap pods.

PQ Media estimates that brands spent over $5 billion using AI as a research tool in 2018, representing almost 10 percent of marketing information budgets, up from a 0.1 percent share in 2013. AI sifts through billions of bytes of daily data to isolate lifecycle trends related to specific target audiences. As a result, brands are better able to personalize marketing campaigns. For example, AI helped a retailer identify couples who were having babies by noting specific products they purchased before the birth. The retailer began sending personalized messages via direct mail and e-mail that matched the child’s age (e.g., diapers and changing tables, followed by toys and bikes and, in upcoming years, technology and dorm room furniture, etc.).

Many non-TV media operators are attempting to persuade brands to shift budgets away from television because viewership is down. That is fake news. According to multiple studies, viewership continues to climb annually, although the method by which video is being consumed is changing. Appointment television viewing of linear, live television is down, but conversely on-demand television viewing on digital and over-the-top (OTT) systems is growing substantially, with the latter driving viewership outside the home. Concurrently, consumers have more choices for content, with almost 500 scripted programs available in 2018, compared with less than 300 in 2009. OTT providers like Netflix, Amazon and Hulu, spent more than $10 billion on original programming to drive subscription growth.

Note: 2017 revenues for all media categories (except for promotional products) have been updated since they were first published in PPB’s July 2019 issue because of recent adjustments in the data reported from various sources. Source: PQ Media’s Global Advertising & Marketing Revenue Forecast 2018-22, except for promotional products; the source for that data is Promotional Products Association International.

* To avoid marketing revenue duplication in media silos, Pure-Play Internet & Mobile Advertising & Marketing is specific to online and mobile sites that are not connected to traditional media brands, such as Google, YouTube, TripAdvisor and e-Harmony. Advertising and marketing revenues generated by digital extensions of traditional media brands (ex., CBS.com) are included in that traditional media silo (ex., Television). The Global Advertising & Marketing Revenue Forecast is one of three reports in PQ Media’s annual Global Media & Technology Forecast Series, which also includes the Global Consumer Media Usage & Exposure Forecast and teh Global Consumer Spending on Media Content & Technology Forecast. The 2018 edition of the Global Media & Advertising Forecast will be available in July. Some data included in the Global Advertising & Marketing Revenue Forecast are gleaned from other PQ Media syndicated reports covering specific advertising and marketing platforms, such as the Global Design Out-of-Home Media Forecast, Global Branded Entertainment Marketing Forecast, Global Content Marketing Forecast, US Brand Activation Marketing Forecast, US Mobile and Social Media Forecast and US Word-of-Mouth Marketing Forecast, among others.

Note: PQ Media is the source of all 2018 size and growth data cited, except PPAI used for promotional products. Media silos are hybrids of traditional and digital media platforms, such as the combination of terrestrial television advertising with branded digital advertising (ex., ad revenues generated by commercials on WCBS and other CBS owned stations + CBS-TV + CBS.com + CBS Mobile + CBS Free VOD + CBS on Netflix).

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Patrick Quinn is president and CEO, and Leo Kivijarv, Ph.D., is EVP and research director of PQ Media. The firm, based in Stamford, Connecticut, is a leading provider of global media econometrics and a pioneer in emerging media research. Its industry-leading predictive econometrics system serves executives charged with advancing strategic initiatives in the rapidly changing media, entertainment and communications industries. www.pqmedia.com