How’s Business In 2016? Most Distributors Anticipate Finishing Strong

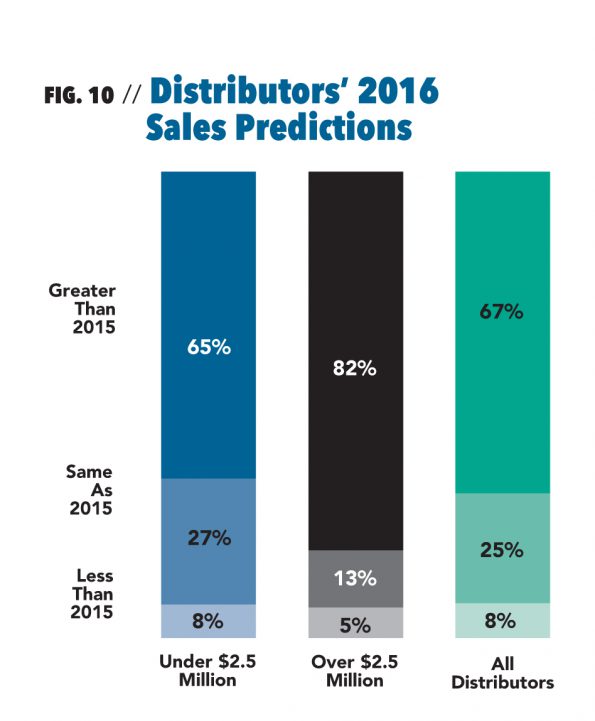

Although many distributors are optimistic about their company’s growth in 2016, there are fewer who expect increased profit margins (62 percent) in 2016 compared to the expectations for 2015 (66 percent), especially among small distributors. Fewer in this group have a positive outlook regarding sales (65 percent) or profit (60 percent) for 2016 in comparison to 2015 (68 percent and 65 percent, respectively). The downturn in the oil and gas industry is expected to continue having a negative impact on many distributors, particularly in Texas.

Howeer, companies that participated in the 2015 survey remain optimistic both about sales and profits for 2016, especially large distributors. More than three-quarters of large distributors feel confident about their sales (85 percent) and profit (76 percent) forecast for 2016.

Although, historically, large distributors are more likely to predict higher sales and profits for the upcoming year than smaller companies, there are significantly more large distributors who predict higher sales and profit margins for 2016 compared to their predictions for 2015, while smaller firms’ predictions remain relatively unchanged.

PPB spoke with the principals at eight small, mid-sized and large distributor companies to see what they are expecting economically for 2016 and to ask about the challenges and concerns that are keeping them up at night.

Anita Emoff

Anita Emoff

CEO and Majority Owner

Shumsky/Boost Rewards (UPIC: SHUMSKY)

Dayton, Ohio

Company: Shumsky was founded in 1953 by Hy and Elsie Shumsky, grandparents of owner Michael Emoff. In 1984, Michael and his mother, Jayne Miller, took over the company. Since then Shumsky has expanded into brand verticals including recognition (Boost Rewards) and medical recovery pillows (Shumsky Therapeutic Pillows). Anita joined the company in 2006 and in 2009 became president of Boost Rewards. In 2013, Boost and Shumsky were merged into one entity with Anita named CEO and majority owner of the Shumsky and Boost brands. The combined companies continue to grow with a focus on differentiation (including traditional and custom promotional products, promotional e-commerce, fulfillment and point-of-sale) to define their space in the market verticals they serve, which includes technology, healthcare, automotive/transportation and retail/consumer packaged goods.

Economic Outlook: “Our bookings are up 16 percent YTD and our billings are up seven percent,” says Emoff. “We expect to end the year up around 10 percent. Our recognition solutions are growing faster than our promotional solutions, but we are driven by more larger opportunities in promotional, which could spike us up quickly over recognition. We experienced a similar situation last year with recognition growing faster.”

Biggest Concerns: “Our biggest concerns for promotional are safety and compliance demands from our larger clients. We must adapt our supply chain to match this demand and [we] find it challenging.”

Marc Katz

Marc Katz

CEO

CustomInk (UPIC: C594384)

McLean, Virginia

Company: CustomInk was founded 16 years ago to help people design and order custom t-shirts online. Since then, CustomInk has grown to be a leader in custom apparel for groups and communities, and has helped its customers create more than 75 million custom shirts. It serves hundreds of thousands of schools, teams, clubs, charities and businesses large and small, in addition to families and friends for all sorts of special occasions. The company employs more than 1,600 people across multiple facilities nationwide. The company uses state-of-the-art screen printing, digital printing and embroidery for most of its production.

Economic Outlook: “We’ve had robust growth over the past few years, having tripled sales since 2012 to over $300,000, and we’ve continued to grow at a healthy pace this year, led by strong customer loyalty and strength in the business category, one of our fastest-growing segments. As a private company, we don’t provide financial forecasts, but we expect to continue growing our historical business, while also expanding newer business lines, such as Booster, a grassroots fundraising platform that helps raise awareness and money for charity through custom apparel sales, and Pear, a sponsorship platform that helps connect brands with national and local groups to fund their custom gear and other needs. This April, we completed the acquisition of Represent, a Los Angeles-based social commerce startup that helps celebrity influencers like actors, athletes, musicians and thought leaders create and sell limited-run t-shirts and merchandise to their supporters.

Biggest Concerns: “This is such a dynamic market with lots of opportunity, so our biggest challenge is generally prioritization and execution. This is particularly true online, where mobile and social trends have fundamentally changed what’s possible, while also upping the ante for what it takes to succeed.”

Bob Lilly, Jr.

Bob Lilly, Jr.

CEO/President

Bob Lilly Promotions, LLC.

(UPIC: BOBL8430)

Dallas, Texas

Company: Bob Lilly Promotions is an industry-leading integrated marketing solutions agency with offices in Dallas, Houston and San Antonio, Texas. It offers customers solutions for promotional products, awards and apparel as well as distribution, fulfillment, printing, packaging, creative design and technology platforms to support program sales.

Economic Outlook: Lilly reports the company is down Q1 year over year by 10 percent but Q2 is slightly up year over year by five percent. “Our pipeline has improved due to new business onboarding as well as higher oil prices. We should finish flat to slightly up YOY,” he says.

Biggest Concerns: “We are focused on creating a company that attracts young, talented people. We recognize the buyers are getting younger and their needs are changing. We want to remain relevant in the way we think about and serve the needs of our customers.”

Jeff Becker

Jeff Becker

President

Kotis Design

(UPIC: kotis752)

Seattle, Washington

Company: Jeff Becker began selling t-shirts to fraternities and sororities at the University of Washington in 2003. After graduation, many of the same reasons students bought from him applied to the corporate world. Since then, the company has brought decoration in house, opened two distribution centers, greatly expanded its technology and now sells to clients across the country. Key markets served include college, beverage and corporate, with services including in-house decoration, warehouse and fulfillment, web platforms and talents of a full creative team.

Economic Outlook: “2016 started strong, but we have seen a slow down since the middle of Q1. Clients are being cautious and conservative with their spending, much of which I’d attribute to their uncertainty in the market (election, retails sales down, gas prices low, international unrest, etc.). We have averaged over 30-percent growth since our inception, and even though sales will definitely be up compared to 2015, we may not hit that 30-percent mark.”

Biggest Concerns: “The biggest concern I have right now is what our economy has in store for us. I see the average American spending less (i.e.: general retail sales down, not upgrading to the new iPhone, spending a higher percentage of wages on rent, etc.). The loss, tightening or delay of budgets may be out of our control. However, if we do our jobs effectively, we should be able to show our clients that the use promotional products will drive sales to combat the decrease. We’ll just have to fight more and get better in all aspects of our business.”

Brian Grall

Brian Grall

General Manager

LogoMyBiz.com

(UPIC: LogoMy)

Evergreen, Colorado

Company: Just launched in 2015 in Oregon and relocated to Colorado this year, it serves mostly small-business clients, with a smattering of corporate America, as well as entities in the beverage industry, education/government and nonprofits.

Economic Outlook: “Year-over-year growth is good, but is ‘good’ ever enough? We have added a few account executives so far this year with intentions to carefully add more by the end of the year. While never content, our outlook for the long term remains enthusiastic.”

Biggest Concerns: “Big-picture-wise, staying relevant in a consolidating industry is our biggest challenge. We are racing against the industry consolidation clock to make sure LogoMyBiz.com becomes established as a relevant long-term player. On a more local basis, the commercial real estate market is a challenge presently, delaying our preference for investment property for an office/conference/showroom. Otherwise it is the typical startup—juggling many balls while developing sales.”

Tim Hennessy, Sr.

Tim Hennessy, Sr.

President

Concepts & Associates

(UPIC: 6971)

Birmingham, Alabama

Company: The 33-year-old company was built on service with an outstanding group of employees, and offers a full range of products and brands, online company store programs, an embroidery operation and global sourcing. It serves markets in the U.S., Canada, Mexico and Europe.

Economic Outlook: Hennessy reports the company is doing well, having had its best year ever in 2015. “We expect a moderate gain in 2016, but with some good luck and fortune, Concepts again could end having our best year ever. There are a number of projects we’ve worked on for a while that came to fruition and we are picking up speed on some things we’ve invested in. You pay your dues and hopefully you get something out of it.” He’s also noticed that the spend level has come back in our industry. “It’s not yet to the ’07 or ’08 level yet but people seem to have some money and they realize they need to spend it to take care of their people. They are doing more with less and have to reward their people and clients. Client retention is paramount—it’s the lifeblood of a company.”

Biggest Concerns: He notes two key areas: Online offering of products from companies outside our industry and the ease of entry into the promotional products industry.

Stephanie Zafarana

Stephanie Zafarana

President

Pica Marketing Group

(UPIC: ezgreen)

Dearborn, Michigan

Company: PMG was established in 2008 during the depths of the recession. During those years of tight budgets, Zafarana noticed a profound need to help marketing executives track and report their ROI and ROO. Services offered today include employee incentive programs, safety programs, company stores, fundraising programs, direct mail and packaging. Key markets served are healthcare, not-for-profit, technology and retail.

Economic Outlook: “As of April 30, we’re up just about 50 percent in gross sales with our average order size up 38 percent. We are not anticipating a slowdown in our business from its current trajectory.”

Biggest Concerns: “Our most difficult challenge right now is growing our business smartly. We are struggling with the idea of hiring a person to help with the administration, research, quotes and orders. Two of our biggest concerns are the sustainability of the role and do we have enough work to fill a fulltime employee? More importantly, [how do we] not sacrifice the client experience as we scale the business. Therefore, in the short run, we are using new technologies to help manage some of the processes and follow up.”

Joe Walkup

Joe Walkup

President

Innovative Business Products, LLC

(UPIC: ibp459)

Nashville, Tennessee

Company: Founded as a print company in 2004, it has expanded offerings to provide promotional products, apparel, warehousing, fulfillment and online storefronts to clients in the banking, healthcare and transportation industries.

Economic Outlook: “We are currently up for 2016. Our business has been up for the past three years and I don’t see it slowing down. IBP is in a growth mode right now. We are looking at new sales reps along with potential acquisitions.”

Biggest Concerns: “I think that consolidation is changing the industry. For the most part I think it is good, but it can make it challenging in other ways. That being said I am looking at doing the same thing.”