Over the last few months, PPAI Media asked industry suppliers of all sizes a series of questions to assess the learn more about their business growth over the last few years.

While promo’s strong rebound year of 2022 is well documented, it only takes stepping back for a little perspective to be impressed by just how much the industry has grown in terms of revenue over a three-year period that included a global pandemic.

The following survey questions, which were also used to score the inaugural PPAI 100’s Growth category, reveal how distributors at multiple competitive bands in the marketplace compare to one another.

While the raw data shows that the largest and smallest suppliers grew at the fastest rates over that time, PPAI Media Publisher and Editor-in-Chief Josh Ellis makes an important note. “When prompted to take the survey, non-PPAI 100 respondents knew they had a chance to earn high marks among the industry’s strongest companies for growth,” Ellis says. “It’s likely that many companies who believed they wouldn’t compare favorably simply chose not to respond, which is heavily skewing the average among smaller suppliers.”

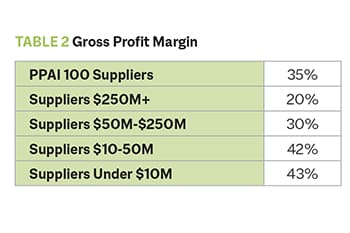

For distributors, this number was more consistent across the segments than the supplier data is showing here. Such a high gross profit margin is a positive sign to see among smaller suppliers.

In June, David Lever, VP of sales at PPAI 100 supplier OTTO International, told PPAI Media he sees gross profit margin statistics and wonders “how much operational efficiencies added to or detracted from gross profit margin.”

The average number of distributor clients among the industry’s largest suppliers (34,967) shows the breadth of promo’s distributorships and the diversity of possibilities that suppliers have with their potential partnerships.

“Our industry is healthy and growing,” Mark Gammon, president and CEO of Cap America, told PPAI Media this year.

The much smaller number when it comes to the under $10 million segment might be attributed to a ceiling in the number of distributor clients some smaller suppliers may be able to partner with given their available resources, but it also speaks to the value of the relationships those suppliers have with the distributor partners they maintain active business with.

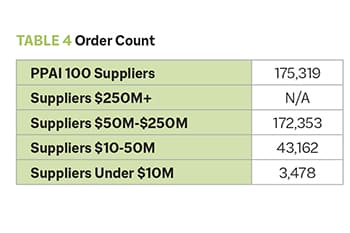

Order count refers to the number of orders processed by a supplier over the course of 2022. Brad Bartlett, president and owner of Opti Print & Fulfillment, used the revenue and order count averages to determine a rough estimate of each order for the companies in the under $10 million segment compared to the PPAI 100 companies.

“The issue that immediately pops out to me is the ability of a business to generate profit with such small order sizes,” Bartlett says. “As we can see from the data, the way the PPAI 100 [companies] do this is to simply generate lots and lots of orders.”

Note: Not enough suppliers making above $250 million reported data for this question to be accurately scored for that segment.

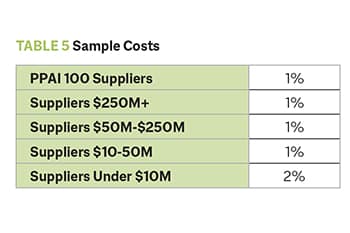

Sample products are a necessary element of the industry, but research among these suppliers shows that a relatively small amount is spent in this area, suggesting streamlined and efficient processes in giving clients and distributors a sense of what they are purchasing.

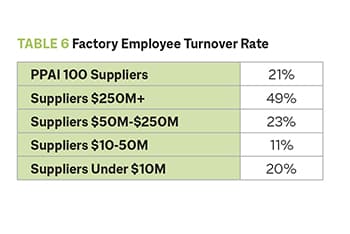

Turnover in factory positions tends to be higher than for office employees, and for most of 2022 and 2023, companies and employees have lived through what one expert described as “the recession that refuses to be.” Many employees were – and still are – willing to regularly look for opportunities that offer better pay or more favorable conditions than their current place of employment.

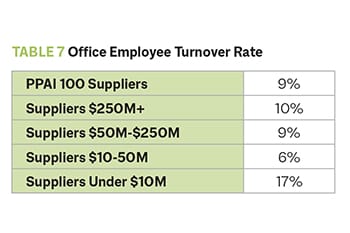

Office turnover rates can vary across companies and are likely to be affected by the environment and internal practices of each company. The higher turnover rate in the under $10 million segment might be attributed to a lower ceiling on average salaries and amenities compared to the largest suppliers.

As suppliers grow, they undoubtedly invest in refining efficiency, the simple explanation for smaller suppliers struggling with on-time shipping compared to their larger competition. Smaller suppliers are also likely to turn out extremely unique, custom products. In any event, “on-time” is a difficult term to measure or define. Melissa Ralston, chief revenue officer of Koozie Group, told PPAI Media that certain realities prevent a perfect score in this regard.

“I don’t think you could ever get to 99% or 100%,” Ralston says. “There will always be supply chain issues or a machine that breaks down. It could be that somebody called in sick that day who runs that machine, or weather conditions – a number of things. Maybe 98% is an attainable average, but I don’t think anything beyond that.”